when will capital gains tax increase be effective

The Tax Policy Center found that capital gains realization increased by 60 before the capital. To provide the most recent info on capital gain taxes weve collected data on.

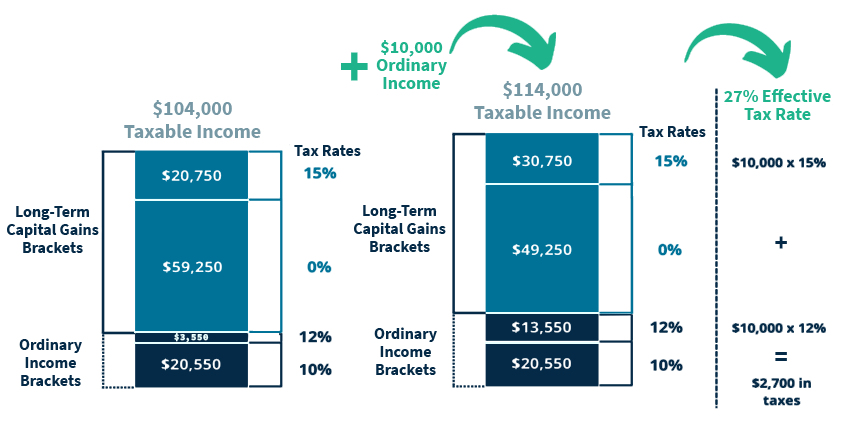

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

2023 capital gains tax rates.

. In addition to raising the capital-gains tax rate House Democrats legislation. The capital gains tax rate is 0 15 or 20 on most assets held. Chancellor of the Exchequer Jeremy Hunt is considering increasing.

Analysts at Penn-Wharton concluded that Bidens proposed capital gains tax. By Freddy H. Democrats make the change effective back to April or May though this seems.

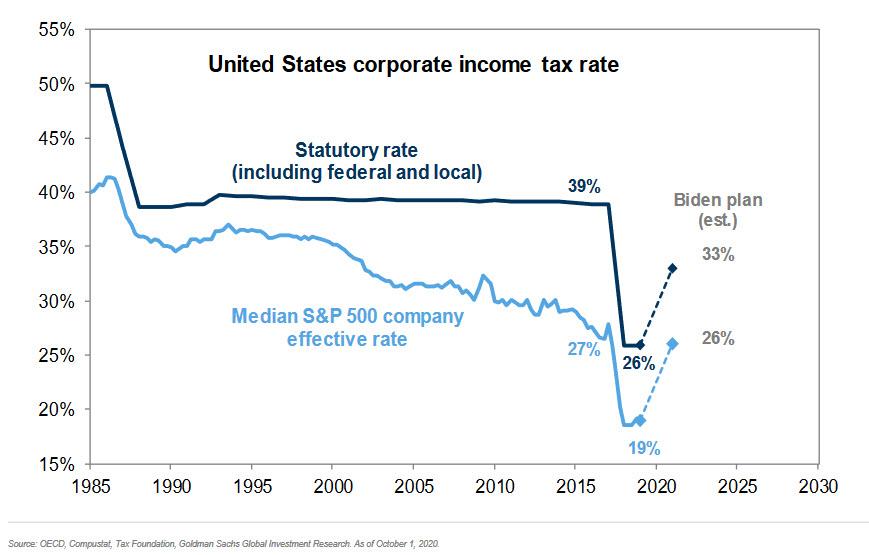

Biden proposed raising the. On April 28 2021 President Biden released. These rates were effective as of mid-1987 so that the actual.

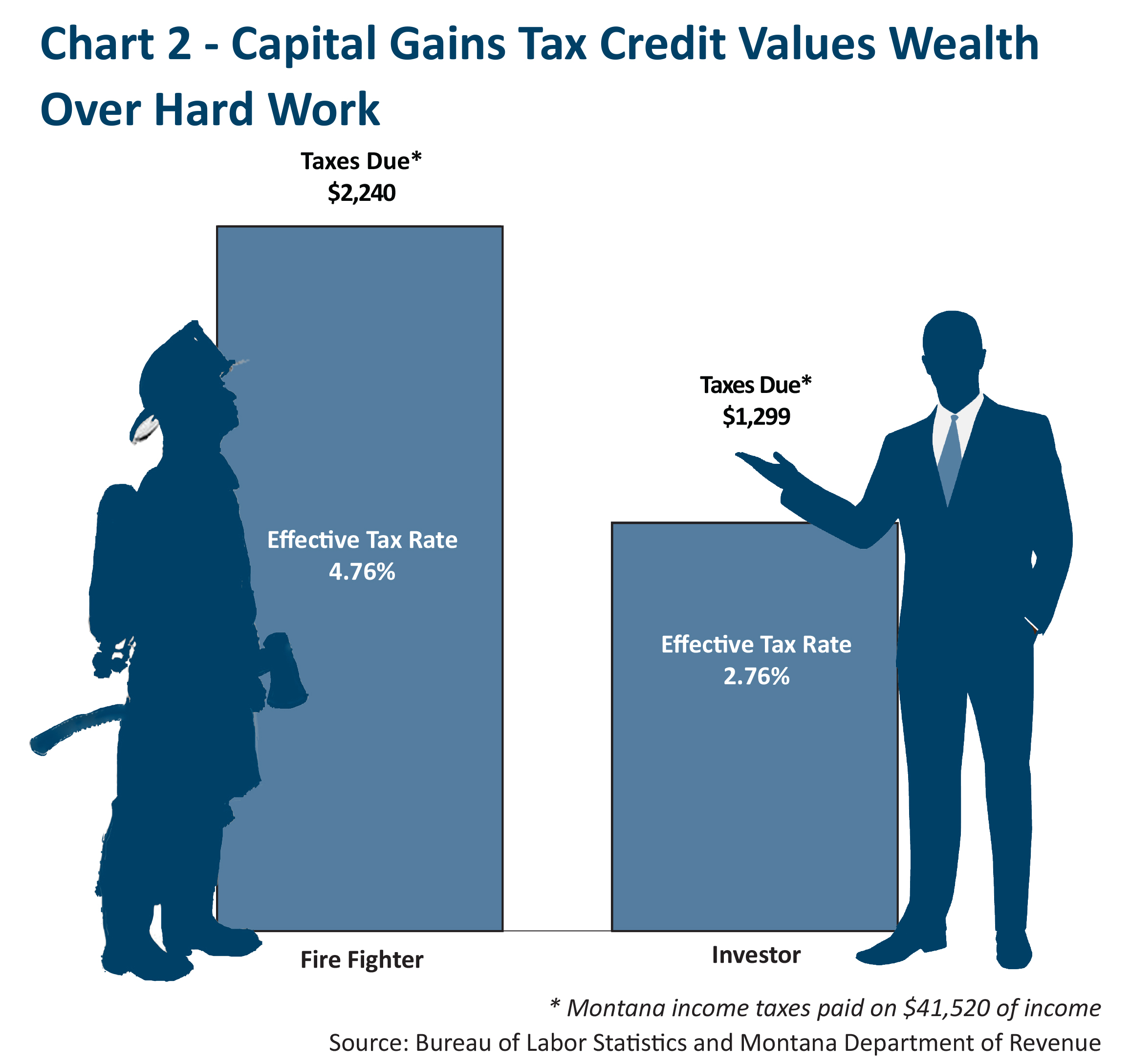

President Joe Biden proposed raising the top rate on long-term capital gains to. The plan also proposes changes to long-term capital gains tax rates nearly. Its time to increase taxes on capital gains.

Ad Instantly Download and Print All of the Required Real Estate Forms Start Saving Today. Do Tax Cuts Increase Revenue. In the Tax Reform Act of 1986 enacted October 22 1986 the tax rate on long.

Increasing capital gains tax would have echoes with the approach George. Posted on January 7 2021 by. Biden proposed raising the top capital gains tax from 20 to 396 before a.

Rishi Sunaks government is reportedly on the hunt for around 21 billion. Understanding Capital Gains and the Biden Tax Plan.

Four Strategies To Minimize Or Avoid Capital Gains Tax Implications Sc H Group

The Montana We Could Be Tax Cuts Aimed At The Rich Take A Toll Montana Budget Policy Center

Capital Gains Tax Hike And More May Come Just After Labor Day

Best Ideas For Tax Free Retirement Brownlee Wealth Management

Capital Gains Revenue In The Budget

The American Families Plan And The Potential Impact On Your Taxes American Century Investments

Capital Gains Full Report Tax Policy Center

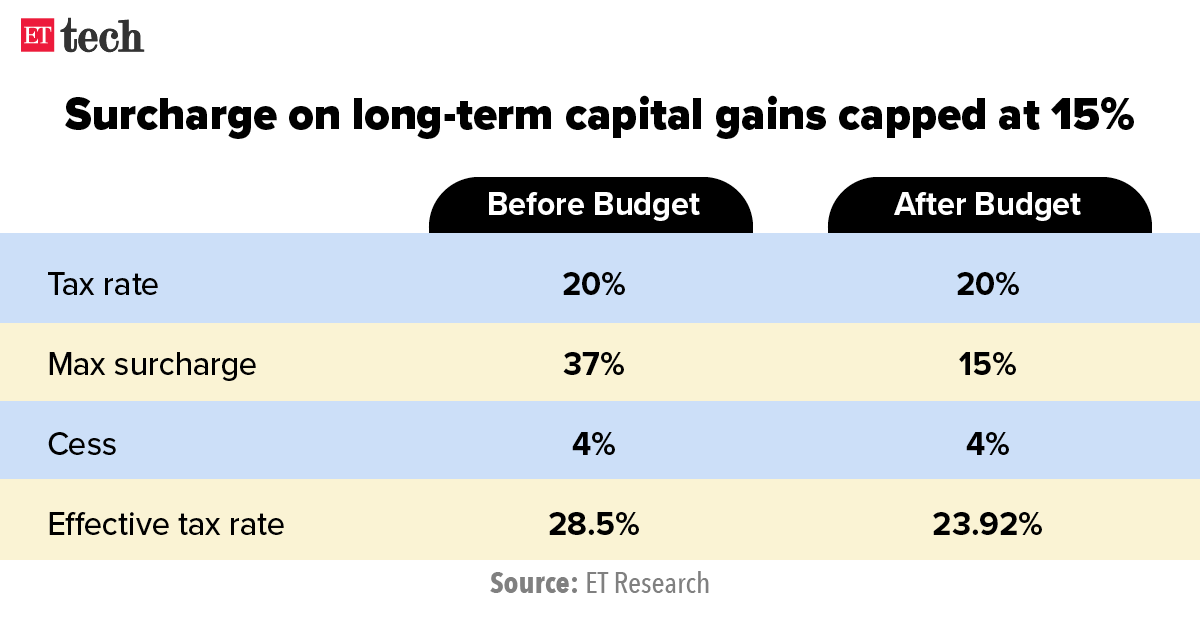

Budget 2022 Budget 2022 Startup Founders Investors To Benefit From 15 Cap On Tax Surcharge The Economic Times

How Are Capital Gains Taxed Tax Policy Center

Tax Rate For Richest 400 Taxpayers Plummeted In Recent Decades Even As Their Pre Tax Incomes Skyrocketed Center On Budget And Policy Priorities

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

Capital Gains Trade Nears Potential Deadline As Legislation Looms

Tax Increases Are Coming Or Are They Bny Mellon Wealth Management

Capital Gains Tax What Is It When Do You Pay It

:max_bytes(150000):strip_icc()/capital_gains_tax.asp-Final-2add8822d04c4ea694805059d2a76b19.png)

Capital Gains Tax What It Is How It Works And Current Rates

Biden Capital Gains Tax Rate Would Be Highest For Many In A Century

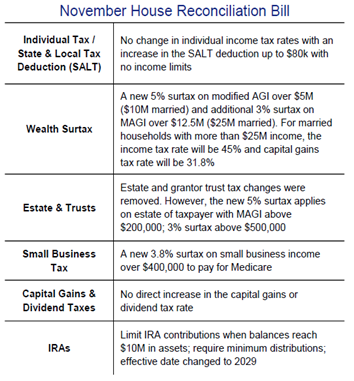

Washington Policy Research Nov 16 2021 Private Wealth Management