portability estate tax exemption

They could use the 5 million estate exemption at the 35 estate tax rate or they could elect to use the 0 estate tax exemption. This provision is referred to as portability For example you would have 606 million of your exemption left over in 2022 if your estate were worth 6 million and with the exemption set at 1206 million.

Locking In A Deceased Spouse S Unused Federal Estate Tax Exemption

For additional information refer to Instructions for Form 706.

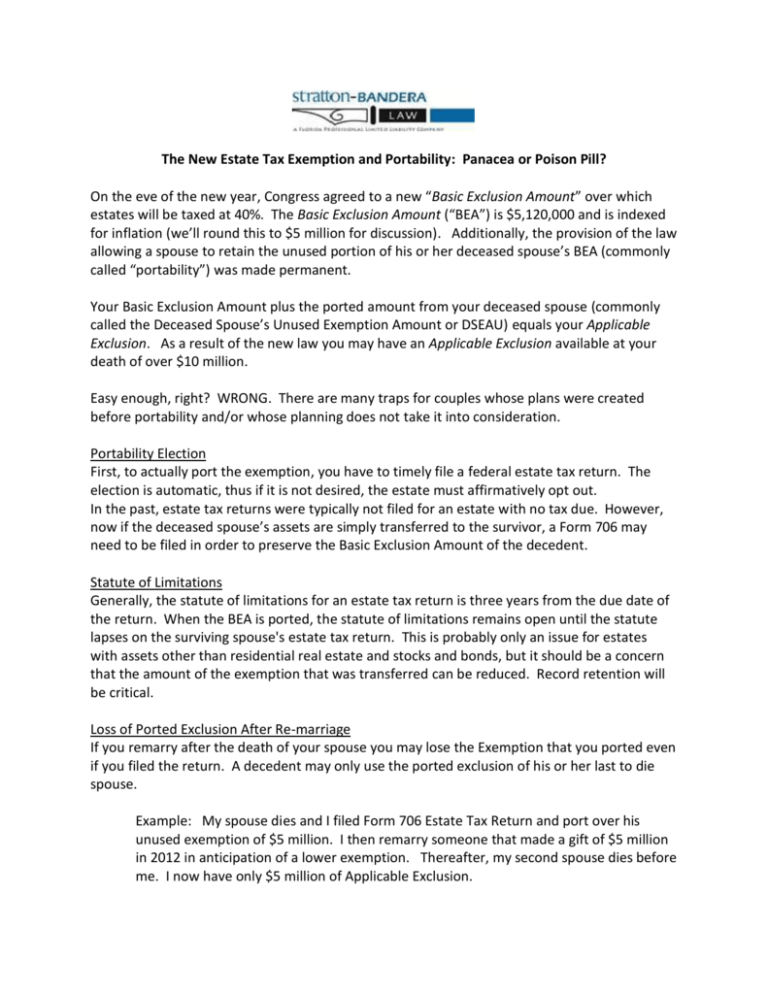

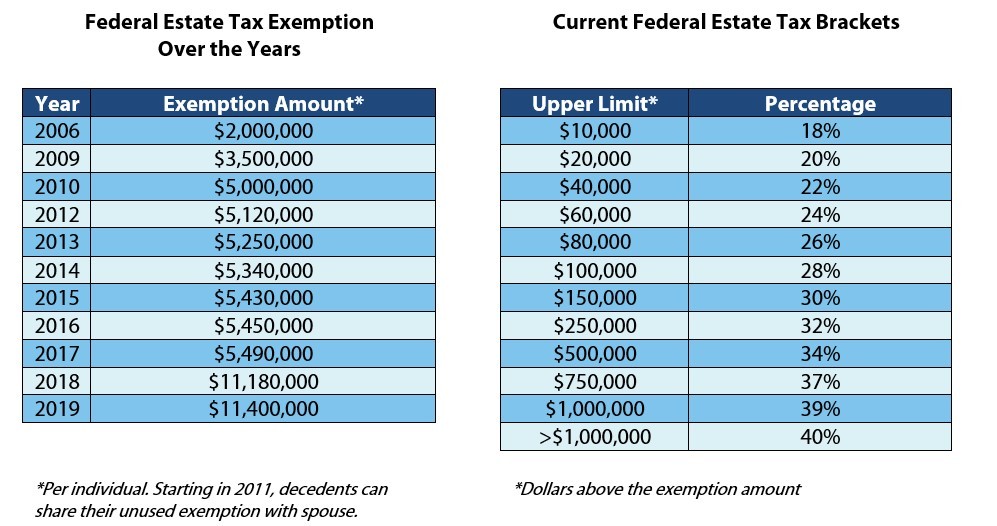

. This election is made on a timely filed estate tax return for the decedent with a surviving spouse. Portability of the estate tax exemption means that if one spouse dies and does not make full use of his or her 5000000 in 2011 or 5120000 in 2012 5250000 in 2013 5340000 in 2014 and 5430000 in 2015 federal estate tax exemption then the surviving spouse can make an election to pick up the unused exemption and add it to the. Note that simplified valuation provisions apply for those estates without a filing requirement absent the portability election.

Homestead exemption application online filing Welcome Ownership Applicants FL Resident US Citizen Verify Information Add Applicants Portability Attachments Complete Welcome to the Miami-Dade County Property Appraiser Online Services.

Exploring The Estate Tax Part 2 Journal Of Accountancy

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Surviving Spouses Need To Know About The Marital Portability Election Natural Bridges Financial Advisors

Portability Of A Spouse S Unused Exemption 1919ic

To A B Or Not To A B That Is The Question Botti Morison

Exemption And Marital Deduction Planning Wealth Strategist Designs

Portability Enabled Traditional Trusts Clark Trevithick Full Service Boutique Law Firm In Los Angeles California Southern California

Portability Of A Spouse S Unused Exemption 1919ic

Credit Shelter Trusts And Portability Eagle Claw Capital Management

Your Estate Plan Don T Forget About Income Tax Planning Kirsch Kohn Bridge Cpas Advisors

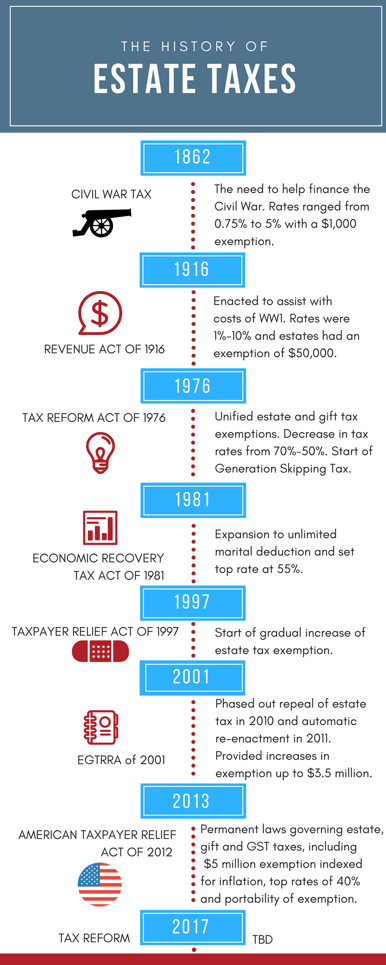

A Brief History Of Estate Gift Taxes

Historical Estate Tax Exemption Amounts And Tax Rates 2022

What Is Portability For Estate And Gift Tax Portability Of The Estate Tax Exemption The American College Of Trust And Estate Counsel

The New Estate Tax Exemption And Portability Panacea Or Poison

Estate Planning Can Secure Your Legacy Jackson Fox Pc Ardmore Ok

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Estate Planning Technique Grantor Retained Annuity Trusts C W O Conner Wealth Advisors Inc Atlanta Georgia